The term “Invoice Number” could be new for you if you don’t have any existing business, but for business owners, this is not a new term at all. In fact, it is one of the most commonly used terms when running a business.

Whenever an invoice is created, an invoice number is assigned to it to keep track of the payments and manage invoice data. For every business transaction, invoicing and e-invoicing (highly evolving) have become the most trusted method for requesting payments from clients.

According to GlobeNewsWire, the e-invoicing market is projected to reach a massive $68.7 billion by 2033, with a CAGR of 16.8% from 2024. This data illustrates the significant role e-invoicing will play in managing business transactions in the years to come.

In this blog, we will explore in detail about invoice number meaning, how to assign invoice numbers, the invoice number format, and their importance, along with other key factors.

📌 Key Takeaways

- An invoice number is a unique identifier assigned to each invoice to help businesses track and manage payments.

- Invoice numbers play a vital role in tracking payments, managing cash flow, and generating accurate financial reports.

- There are five methods to assign invoice numbers, where the most popular ones are sequential and alphanumeric numbering.

- Manual invoicing often leads to numbering mistakes, but selecting an online invoicing software makes invoice numbering a lot easier and error-free.

- You can reset invoice numbers if you face issues like excessively long invoice sequences.

What is an Invoice Number?

An invoice number can be defined as a unique identifier that is assigned to each invoice a business issues. Consider it as a reference code that keeps track of every transaction. Without an invoice number, managing invoices could get tricky and error-prone.

Generally, invoice numbers are a combination of digits, letters, or even both (called alphanumeric invoice numbers), depending on the system you use. For example, an invoice number could look like FXI-0054, 2035-0005, or PERP05-154. The exact invoice number format isn’t fixed, but it needs to be consistent across all your invoices to maintain order easily.

It can’t be any random format you can choose; the invoice number should have some relevance to your business.

Let’s understand this.

Suppose you are running a business named “Coholt Enterprises Pvt. Ltd.”

You can assign the number for all your invoices with “CEPL-0001”, “CEPL-0002”, like this (increasing order for new invoices). It will bring more clarity and help you manage your invoices.

The invoice number acts as the “address label” of your invoice, which is vital in financial documentation.

Are You Still Numbering Invoices Manually?

No more! Switch to Moon Invoice and number your invoices smartly without any errors. Create invoices that showcase your brand.

How to Assign Invoice Numbers?

Are you wondering “how to number invoices?” There are multiple ways to number your invoice. Let’s understand this in detail.

Assigning invoice numbers that are relevant to your business name is not the only method of numbering invoices. There are multiple ways to assign numbers into your invoices. When you follow the best method, helps you track payments and avoids confusion.

Here are the most common invoice numbering system you can consider:

1. Sequential Numbering

The easiest yet effective method to number your invoices is to follow a proper sequence, such as 001, 002, 003, and so on. If you are a startup or freelancer, you can start invoicing with this method.

For example, the first ever invoice created with sequential invoice numbers will be “XYZ-001”, then the next will be “XYZ-002,” etc.

2. Date-Based Numbering

This is one of the commonly used numbering methods. Here, the date of issue is added with the invoice number, which makes it easy to track (date-wise).

For example, an invoice issued on 12th August 2025 will look like 2025-08-12-001. This method is very useful if you deal with day-to-day clients.

3. Customer or Project-Based Numbering

As the title suggests, in this method, you can assign numbers based on customer ID or project code to easily categorize invoices.

For example, the invoice for client A will be like CUST-A-001, and for client B, it will look like CUST-B-001. In this method, you can quickly find out which client or project the invoice belongs to.

4. Alphanumeric Numbering

This invoice numbering method is for businesses willing to create a more customized system. Alphanumeric, as the name suggests, combines numbers and letters to create invoice numbers.

For example, INV-A-0001 or DZ-A-00-0001. These types of numbers make the invoice look more professional. This is a highly effective invoice numbering system mostly used by large-scale enterprises.

5. Custom Numbering Systems

Some numbering methods include designing your own unique numbers that fit your workflow. For example, you can combine date, sequence, and project elements. Following this method, an invoice number example would look like 2025-AMX-CUST-A-0010. This number gives you an instant idea about the year, the client’s business name, the client’s name, and the sequence number all at once.

Don’t get confused between “what is an invoice number” and “how to assign an invoice number.” Regardless of the invoice numbering method you choose, the key is maintaining consistency. Once you select a format, stick to it across all invoices.

💡Also Read:

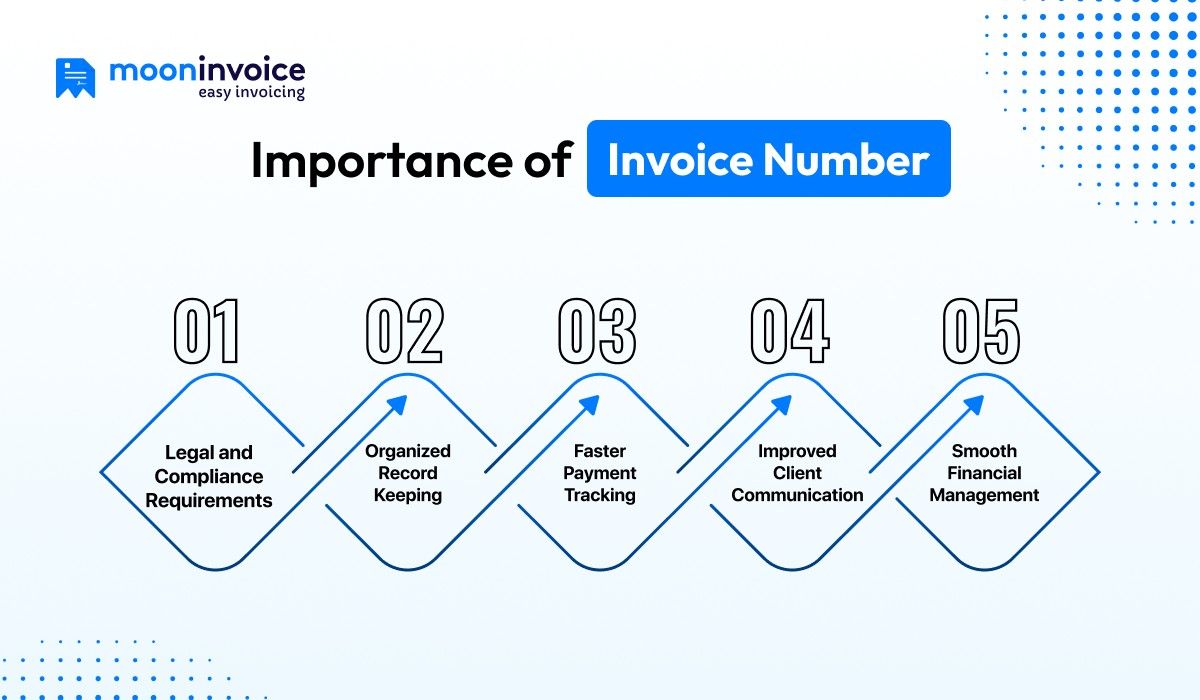

Importance of Invoice Number

To establish compliance, financial management, and client communication, the invoice number is important. Tracking payments and proving financial records will become very difficult without an invoice number.

Here is why invoice numbers matter:

1. Legal and Compliance Requirements

In most countries, it is necessary for businesses to issue invoices with a unique invoice number legally. It helps legal authorities verify transactions and ensure your business is compliant with tax laws.

2. Organized Record-Keeping

For a specific invoice, a sales invoice number is assigned, which makes tracking and record-keeping easier. It simplifies the workload while preparing tax returns, conducting audits, or reviewing past sales.

3. Faster Payment Tracking

The unique identifiers make sure invoices are tracked easily, meaning you can check which invoices have been paid, which are pending, and which are overdue effortlessly.

4. Improved Client Communication

In case of a dispute or clarification with the client, referencing the invoice number speeds up resolution. Simply mentioning the invoice number, like “refer to invoice #2015,” reduces confusion.

5. Smooth Financial Management

When you handle multiple projects, this number helps differentiate and categorize them separately. This way, you can always make better decisions for your business and make invoice management hassle-free.

Messy Invoice Numbers Slowing Down Your Finances?

Don’t let poor numbering hurt your cash flow. With Moon Invoice, you can create error-free invoice numbers and track payments seamlessly.

When to Reset Invoice Number?

The invoice number has to be sequential and continuous, but there are times when you are required to reset the invoice number. Resetting invoices after a long time helps you get started with a new sequence and keep records organized. Resetting the invoice number has to be done with careful attention. A minor mistake could lead to duplication of invoices, forgery, and compliance issues.

Here are the possible scenarios when you can reset invoice numbers:

1. Start of a New Financial Year

For tax and accounting purposes, resetting invoice numbers at the start of a new financial year is a wise decision. For example, instead of starting your invoice from “INV-DZ-1215,” you can reset it and start with “INV-DZ-2025-001” for the new cycle.

2. Change in Business Structure

If you are restructuring your business (i.e., changing from a sole proprietorship to an LLC, opening a new branch, or rebranding your business), starting a new sequence is more effective. It will help you segregate old invoices and new invoices easily.

3. Switching Accounting or Invoicing Software

When a new invoicing software or accounting software is installed, you can consider resetting invoice numbers so that it will be easier to match the new system’s formatting.

4. Separate Numbering for Different Projects

This is not a reset but more like a distinction between two or more projects. Suppose your business is handling three projects for different clients, but the sequence of invoice numbers is the same; it can create a lot of confusion. In such cases, you can create three separate invoice number systems for each project.

5. Excessively Long Invoice Sequences

If you have been following the same sequence to number your invoices for over 2-3 years, it is a long time, and you should consider a reset. For example, resetting the number from “CEPL-RE-2025-124574” to “CEPL-RE-2025-0001” makes the record clean and easy to track.

How Can Online Invoicing Software Help?

As a business owner, you can’t always stick to manual invoicing, especially when your business is growing. With time, your workload will increase, and soon, invoicing could feel like a burden. Errors, mistakes, duplicate invoice numbers, skipped sequences, inconsistent formats, there are many such issues you might face when you choose manual invoicing.

To overcome all these, you can think of investing in an invoicing software that simplifies processes and helps you focus on other tasks.

An invoicing software will help you number invoices easily by selecting a numbering method as per your business requirements. Another advantage of using invoicing software is that it keeps the data of all existing invoices, so you don’t create an invoice with the same invoice number.

If your business is growing and you are looking for invoicing software, you can consider Moon Invoice. Here’s what you will get with Moon Invoice:

- Automated Invoice Numbering: You can create invoices without worrying about how to number invoices.

- Multi-Client and Project Support: You can assign a different sequential numbering system for multiple invoices while working on different projects and keep records organized.

- Error-Free Compliance: Every invoice number is a unique one that is created using the Moon Invoice software. It makes audits and tax-filing of your business smoother.

- One-Click Reporting: Create financial reports in just one click. No need to juggle through complex data, which can be time-consuming.

- Recurring Invoices: You can easily set up recurring invoices for repeated clients without worrying about assigning invoice numbers.

Wrapping Up

The invoice number is the most important part of an invoice. Unique invoice numbers like sequential, double, or triple figures are the reason why tracking invoices and referring to invoices for different clients has become easier.

It is always recommended not to follow numbering in serial numbers or one type like “1234” or “6579” as there are maximum chances of duplication and fraud. You can number your invoices using an alphanumeric numbering system, date-based, or sequential to ease invoice tracking.

If you are tired of assigning invoice numbers manually, you can consider Moon Invoice. The software will not only take care of your numbering but also help you create invoices from 65+ invoice templates.

Check out Moon Invoice today!