Do you feel that in 2025, business insurance is a must thing? Have you heard about general liability insurance or commercial property insurance? Are you running a contracting business? Then, don’t you feel that contractor or construction insurance is necessary for the business?

We will try to cover all these questions in this blog. This blog is exclusively about contractor insurance costs, contractor liability insurance costs, insurance for independent contractors, subcontractor insurance costs, and much more.

Proper insurance coverage by calculating general contractor insurance cost via an insurance company is vital for ensuring the business’s longevity and stability.

Want to have cheap contractor insurance or insurance for independent contractors? Continue reading.

What Is Contractors Insurance?

Contractor’s insurance is an essential type of coverage that shields contractors from potential financial loss caused by unexpected events such as jobsite accidents, equipment breakdowns, or business property damage.

It provides legal protection and typically includes General Liability insurance, Commercial Umbrella insurance, Worker’s Compensation Insurance, Inland marine insurance, Equipment Insurance, and Commercial Auto Insurance. It helps ensure peace of mind so one can focus on completing jobs effectively without worrying too much about sudden setbacks.

We will further be discussing contractor insurance cost and general contractor insurance costs with subcontractor insurance costs. An insurance policy is a smart move toward long-term success in any construction trade.

👉 Note that when you opt for a policy, look after insurance costs, coverage limits, legal costs, etc.

How Much Does Contractor Insurance Cost?

Contractors must consider certain variables to accurately calculate their contractor insurance cost. These include:

- The chosen coverage amounts

- How many Employees do you have

- Previous claim history

- Business assets/property ownership

- Location & property size

- Payroll

These elements impact general contractor insurance costs. Or you can say you must be careful about these factors while calculating general liability insurance costs for contractors. Always discuss matters with an independent agent for clarity and accuracy in understanding true financial obligations associated with obtaining proper protection against risks and unexpected events affecting your company’s well-being.

As always, remember to recheck everything before using any info provided herein. This includes verifying all sources mentioned above if deciding to look into anything further.

In addition, ensure you remain cautious about utilizing language recognition software after receiving answers since we cannot guarantee its validity due to possible updates made by developers, which might alter the performance characteristics of users like yourself right now! Have a great day!

Don’t miss any elements while going for cheap contractor insurance or a commercial auto policy.

Want to Have An Affordable Invoicing Tool?

Moon Invoice is your go-through software that can streamline your invoicing process in minutes.

Who Needs Contractors Insurance?

Contractor insurance is essential for a wide range of professionals and businesses in the construction and contracting industry.

While the specific insurance needs may vary depending on the type of work and size of the business, here are some common groups and individuals who should consider contractors insurance:

General Contractors: They need insurance to protect themselves against potential liability claims, property damage, and injuries that may occur on the job site.

Subcontractors: They require insurance to protect themselves and their clients from liabilities associated with their specific trade.

Homebuilders: Builders who construct residential properties need insurance to cover potential defects in construction, property damage, and injuries that may happen on the construction site.

Renovation Contractors: Those who renovate existing structures need insurance to cover potential damage to the property during renovations, as well as liability in case of accidents on-site.

Specialty Contractors: Specialty contractors like roofers, HVAC technicians, and landscapers need insurance tailored to their specific trade to cover risks unique to their work.

What are The Coverage and Pricing Options for General Contractor Insurance?

Now that we have discussed contractor insurance costs, General contractor insurance encompasses various forms of protection designed to safeguard construction companies from potential financial losses resulting from incidents such as property damage, accidents involving injuries, or legal disputes.

Choosing appropriate coverage (general liability insurance cost for contractors or insurance for independent contractors) depends on carefully evaluating one’s unique risks and exposure to potential losses, given the nature of the job and the operating environment in which the contractor operates. Here is a stat before we come to the general contractor insurance cost.

1. Contractor’s General Liability (General Liability Insurance)

Working on construction projects comes with many risks and hazards as a general contractor. General Liability Insurance is one of the most critical types of insurance that every contractor needs.

Also known as “GL,” GL insurance provides essential coverage to third parties who could sue you over physical or advertising injuries they sustain during project completion. We will see about general liability insurance costs for contractors.

Your small business can avoid debt by investing in affordable yet reliable coverage options to keep financials afloat despite challenging times. When seeking the best general liability insurance rates for contractors or insurance for independent contractors, it’s crucial to understand what influences prices first.

Let’s take a closer look at some key elements driving this contractor insurance cost:

Location

Covering multiple job sites spread across different regions? That means there’ll likely be increased odds of an accident due to population density. Even though your primary business focus may reside elsewhere, accidents happen where they happen — potentially leading to additional premium costs across areas where you’ve done work in the past or plan to do so later.

Number of Employees

Every person added to the payroll ups your chances of encountering trouble due to employee actions or neglect. Plus, crews tend to grow and shrink throughout a project timeline. More hands mean a heightened likelihood of mishaps occurring regardless of job site location(s).

General Contractor Insurance Cost

To secure your construction firm against unwanted incidents involving third parties, you can purchase Thimble’s “General Liability” coverage. They offer two coverage limit choices for customers, $1M and $2M per incident. If you pick the latter option, remember it involves an extra cost because the elevated coverage guarantees better security in case a disaster happens unexpectedly.

While some contractors cringe at shelling out $800 annually for their General Liability policy, they forget about the steep legal bills and other costs of a single successful Bodily Injury claim.

The general liability insurance cost for contractors is the key for the business because splurging a few hundred dollars annually saves you thousands in the long run by protecting your assets before they disappear in a flurry of court settlements and attorney fees.

2. Workers’ Compensation Insurance

Workers’ Compensation insurance is one of the business insurance policies when you have employees unless you operate in Texas. This type of insurance provides financial support to workers who sustain physical harm or become unwell due to their professional responsibilities.

Coverage includes various benefits to aid your employees in recovering financially, physically, and emotionally after facing occupational hazards. As we delve deeper into this topic, let us explore the details of Workers’ Compensation insurance further.

Protect Your Team

By law requiring Workers’ Compensation insurance when hiring personnel, states aim to provide safety nets for employees and employers. Employees receive assurance that their health issues stemming from job requirements won’t leave them struggling financially.

As an entrepreneur, purchasing this coverage demonstrates responsible corporate citizenship, showing awareness of employee needs beyond meeting minimum statutory provisions. Let us take a look at what this policy covers.

What Workers’ Compensation Covers

This policy caters to numerous areas vital for helping employees resume normal lives following job-related troubles working for general contractors. The list below highlights typical benefits:

1. Medical Treatments

These cover medical expenses and medical bills for diagnostic evaluations, medications, therapies, hospital stays, surgeries, doctor appointments, lab tests, X-rays, ambulance services, dental treatment, prosthetics, assistive devices, and prescription drugs related to job accidents or diseases.

2. Ongoing Care

Continuous assistance and similar procedures linked to job incidents or workplace injury. Surgery follow-ups, home health services, social or vocational reintegration programs, disability management initiatives, personal attendant services, hospice care, parenteral nutrition elements, hearing aid fittings or replacements, cardiac rehabilitation, speech therapy sessions, pulmonary rehab, neuropsychological testing, blood derivative products, and air ambulance transportation could also be eligible depending on each unique situation. Regular updates might lead to additional items included or excluded from your plan details.

3. Coverage for Loss or Damage to Equipment

Contractor equipment insurance encompasses multiple forms of protection under one policy umbrella, including equipment breakdown insurance, which may provide funds to fix or replace gear harmed by mechanical failure, power surges, or human error.

To clarify how this works better, imagine a bulldozer experiencing engine problems. Depending on the situation’s details, you could turn to your equipment breakdown insurance provider since purchasing new heavy construction vehicles would likely prove expensive and time-consuming.

Deductibles vary based on policy specifics and individual company choices, though some common amounts range between $50 and $5,000.

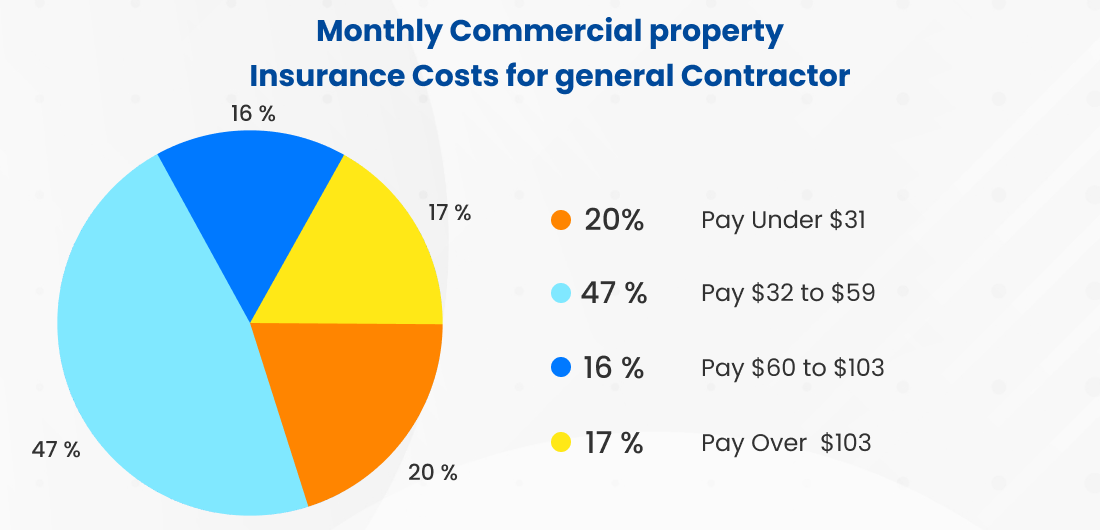

4. Commercial Property Insurance

The primary purpose of commercial property insurance is to offer financial protection against damage to physical structures, contents inside those properties, and loss of income when unexpected events occur. Policy inclusions vary according to insurers but aim to safeguard real estate investments and belongings entrepreneurs use across industries.

For instance, retail store owners must consider product inventory risks alongside building fixtures or shopfront displays requiring protection. Likewise, office managers require adequate space, furniture, technology hardware, and supplies to conduct day-to-day operations. Typically, commercial property protections address significant physical assets and revenue streams that jeopardize continued viable operations following disaster strikes.

This contractor insurance cost fluctuates, and it is based on numerous factors impacting a given enterprise along with insurance market conditions determined by geographic location and economic cycles.

How Do I Get A Quote For General Contractor Business Insurance?

Getting a quote for general contractor business insurance, subcontractor insurance cost independent cost, etc., involves contacting trusted insurance companies that offer comprehensive coverage suited to your specific trade.

Be very careful about determining contractor liability insurance costs. Here is a compiled list of prominent firms worth considering:

- Berkshire Hathaway Homestate Companies

- Travelers

- Chubb

- State Farm

- The Hartford Steam Boiler

- Progressive Business Interruption Protection

Reaching out to representatives at these organizations directly allows you to discuss your project scope and estimate approximate rates based on several variables, including company size, nature of work performed, and total gross sales volumes.

Gathering multiple quotes helps evaluate competitive offers and negotiate preferred terms with chosen providers to achieve optimal risk management practices protecting your construction venture. Don’t hesitate to ask about complementary liability package deals integrating important features like workers compensation or employer’s liability components critical for maintaining safe job sites and minimizing incidental claims potentially leading to costly lawsuits.

But if you are a contractor and need to send quotes or convert the quotes into an invoice, then you must go for Moon Invoice. Our intuitive platform simplifies creating and tracking invoices in just minutes with an independent contractor invoice template. Whether running a small startup or scaling up your established business empire, our adaptable tools keep everything organized and automated – leaving more room for growth. Sign up now and discover why customers love us!

Stop Worrying About Invoicing for Your Contracting Business

Get Moon Invoice’s Invoicing App that is best suitable for your contractor business with the best independent contractor invoice template.