A proper accounting is a pillar of a successful business. Fortunately, in the digital era, there is plenty of software available to manage accounts and invoices to let a smooth cash flow be a part of the business.

FreshBooks is one of the well-known accounting software companies. Users are aware of its key features to manage the overall billing and financial actions. Its plans are well-suited for freelancers and sole proprietors.

However, limitations exist everywhere so FreshBooks might not be adaptable for all. However, it doesn’t mean there is a full stop on the invoicing story. Here, we will introduce you to top FreshBooks alternatives that could provide you with better options.

FreshBooks Invoice Alternatives: A Quick Comparison

There are many FreshBooks alternatives available to make the accounting process handy. Here is a comparison of the top alternatives of FreshBooks. The comparison is based on price and key features of invoicing software.

11 Best FreshBooks Alternatives for All Business Types

1. Moon Invoice

Moon Invoice is one of the best alternatives to FreshBooks that offers advanced features to streamline the financial activities of a business. This is a complete package to manage your financial activities in one place. This software offers customized templates for invoices for a handy process for professionals.

Beyond invoicing, this software offers the option to manage estimates, and expenses, creating purchase orders, delivery challans, credit notes, and sales receipts and helps small businesses automate financial processes. Regardless of the business nature and size, Moon Invoice is one size fits all.

Key Features

Invoice Templates: The software offers 66+ invoice templates which are highly customizable to cater the specific needs.

Recurring Billing: Moon Invoice lets you schedule your billing through recurring invoices.

Multi-currency option: Our platform currently offers 100+ currency options. A user can set the currency as per the need for any international transaction.

WhatsApp sharing: A user can easily share the invoice, estimate, proforma invoice, and sales receipt on WhatsApp.

Activity log: Keep track of all the activities performed through the activity log option.

Signature request: This feature enables professionals to make requests for signature to the client.

Offline Sync: No need to connect data to the server as Moon Invoice supports the work offline concept.

Payment integration: The system has 20+ popular payment gateway integrations to accelerate payment acceptance. Clients can pay feasibly with custom payment integration.

Tax calculation: Moon Invoice lets the user choose the tax type and enhances the automated tax calculation.

Pros

- Offers 66+ invoice templates

- Provide multiple gateways

- Easy to customize

- Availability of import feature

- Data security

- Good for inventory and vendor management

- Great customer service through email and phone

- Invoice tracking to track every detail of the invoice

Cons

- Advance features are only available in premium plan

- Data can be synced only once your internet is restored

Pricing

- Bronze plan – $5.47 per month

- Silver plan – $6.83 per month

- Gold plan – $10.25 per month

- Platinum – $44.42 per month

Free Trial – Available for 7 Days

Elevate Your Brand with Customizable Invoice Templates.

Discover 66+ invoice templates for your business. Speed up your billing with accuracy.

2. Invoicely

Invoicely is another alternative to FreshBooks and a popular accounting software. This platform offers advanced features to make invoicing easier and closer to accuracy. Along with managing the finances, this tool is also useful in project tracking. The platform helps eliminate the paperwork and replace it with an advanced invoicing process. This invoicing software is good for small businesses and entrepreneurs for managing small business accounting.

Key Features

- Accepting online payments through credit card and other payment gateways

- Managing multiple businesses in one place

- Customized reports

- Tracking of hourly bills and expenses

Pros

- Supporting multi-languages

- Easy to use

- Useful for project estimate

- Easy to use with a good use interface

Cons

- Limited integration

- Customization is limited

- Customer support is not up to the mark

Pricing

- Free Plan – $0

- Basic plan – $9.99 per month

- Professional plan – $19.99 per month

- Enterprise plan – $29.99 per month

3. Wave

Most suitable for small vendors, wave is another free cloud-based accounting software. Regardless of the number of users, it is free of cost which makes it one of the better alternatives. Its customized invoice templates open the door for a simple invoicing process. However, an inventory management feature is not available on this platform.

Key Features

- It helps to manage accounting with multiple businesses

- Generate reports with few clicks

- Expense and income management

- Customer Relationship Management integration

- Supporting multi-currency

- Reporting

- Simple and reliable tax flow

Pros

- Offers customized templates

- Unlimited invoicing

- Free of cost (free plan)

- Good for freelancers

Cons

- Live or phone support is not available

- Price is high

- An additional fee is applicable to access certain features

Pricing

- Free plan – 0$

- Pro plan – $16 per month

4. QuickBooks

QuickBooks is another one of the alternatives to FreshBooks and a popular small business accounting software.

This accounting software is USA-based. It eliminates the time-consuming setup and is easy to deal with. This accounting tool is useful for expense tracking, data importing, payroll management, bank reconciliation, and invoicing. It connects with your bank account and shows real time transactions. The software comes with an easy user interface for simple navigation.

Key Features

- Automatic billing

- Expense monitoring and management

- Payroll management

- Third party integration

- Financial management and reporting

- Inventory management

Pros

- User-friendly and easy to use

- Easy to integrate with third party

- Set Up a payroll

- Customized templates

Cons

- There are frequent updates in the software

- Need of training to operate it

- Quite costly for a sole business owner

Pricing

- Simple start – $18 per month

- Essentials – $27 per month

- Plus – $38 per month

- Advanced – $76 per month

5. Zoho Invoice

Zoho Invoice is one of the popular FreshBooks alternatives to streamline the business workflow. It holds a popular tag in the market. It simplifies tracking, expense management, invoicing, and accountant collaboration.

The accounting software offers free tools for invoice templates, estimate generation, and receipt generation.

Key Features

- Managing the quotes efficiently

- Monitoring the expenses

- Sending payment reminders

- Financial management

- Scheduling recurring invoices

- Inventory management system

- Managing Purchase Orders

Pros

- Good user interface

- Easy for expenses and inventory management

- User friendly

Cons

- Data extraction is difficult

- Customer support is not satisfactory

- Quite an expense for small businesses

Pricing

- Standard plan – $20

- Professional – $50

- Premium – $100

6. Invoicera

An Indian-based invoicing software, Invoicera is another popular choice to streamline the billing process. One of the FreshBooks competitors, this platform provides customized templates, invoice automation, and real-time tracking. It offers various options for online payments to simplify the process.

Invoicera is suitable for all business standards from small startups to big enterprises. It’s all in one platform to handle invoicing actions for all small and growing businesses.

Key Features

- Automated recurring invoices for automated billing

- Easy to integrate with third-party

- AP and AR management

- Supporting multi-currency

Pros

- Offers payment gateways

- It is easy to import expense files

- Easy to integrate with online payment services

- Very flexible to use

Cons

- Bank activity tracking is not possible

- Third-party integration is lacking

- Unlimited features are only available in premium plan

Pricing

Infinite plan – $149 per month

7. Invoice2go

Invoice2Go is customizable billing software that operates on a cloud concept. This invoicing software is also good for freelancers and small businesses. It offers various customized templates for making a professional invoice in less time. It offers a 30-day free trial. Business professionals can easily manage their projects with this tool.

Key Features

- Customized templates for invoice

- Sending outstanding invoices through email or WhatsApp

- Accepting online payment through credit card, debit card or PayPal

- Integration with third party

- Report generation

- Project management in one place

Pros

- Simple to use

- Customization options are broad

- User-friendly interface

Cons

- The basic plan has limited integration

- Not suitable for complex small businesses

- Billing structure is quite complex

Pricing

- Starting plan – $5.99 per month

- Professional – $9.99 per month

- Premium – $39.99 per month

8. Bill.com

A USA-based billing software, Bill.com offers one of the best solutions to streamline business billing and managing finances. It is also a cloud-based accounting software. This platform also offers customizable invoice templates to accelerate the invoicing process. It accepts online payment through ACH and credit card.

Key Features

- Expense management

- Recurring payment

- Automated bill payment

- Invoice management

- Tracking of payment

- Multi-currency support for international payments

- Detection of fraud actions

Pros

- Third party integration is available (with Quickbooks)

- Various online payment options are available

- Customization is available

- Very handy to use and user-friendly interface

Cons

- Customization report is limited

- Customer support service is less to quality oriented

- Integration with other tools is available but difficult

Pricing

- Essentials – $45 per month

- Team – $55 per month

- Corporate – $79 per month

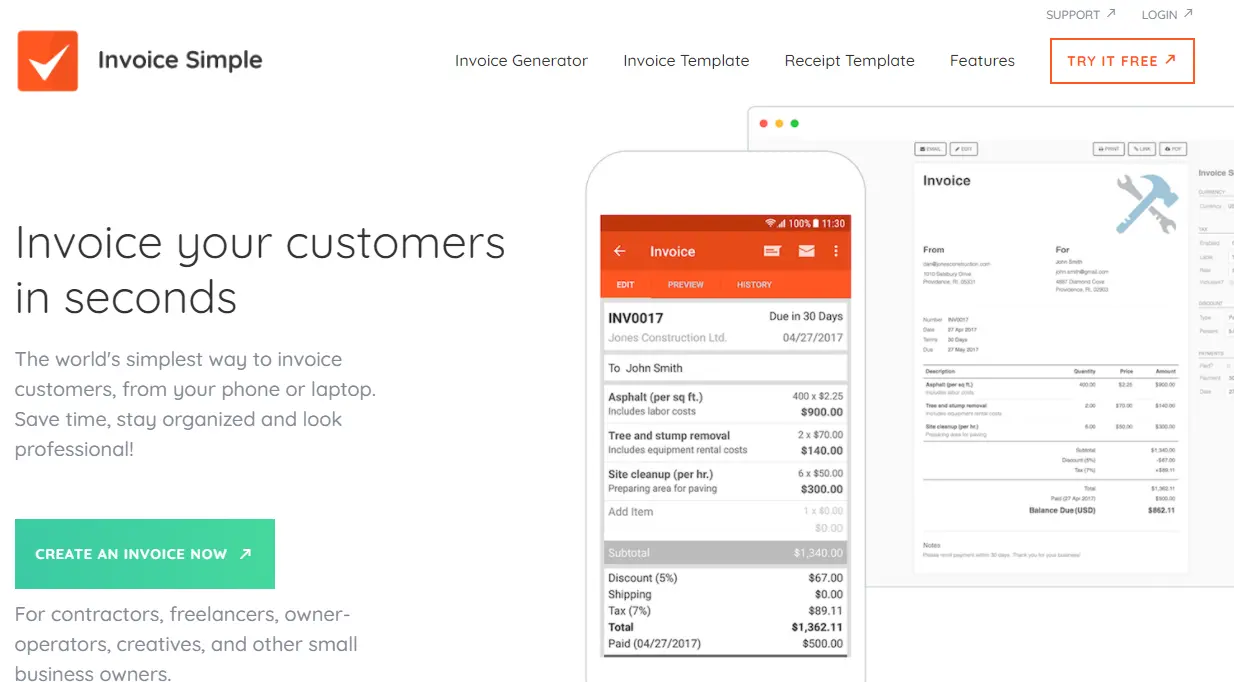

9. InvoiceSimple

InvoiceSimple is one of the popular invoicing tools that enables users to create and send invoices through a laptop or phone. It is perfect invoicing software for contractors, small business owners, and other freelancers. In addition to invoices, this platform is ideal for creating receipts, estimates, and business expense reports with more advanced features.

Key Features

- Easy report generating

- Supporting 25 currencies

- Tracking of business expense

- Multiple payment options

- Security of data

- Invoice notification

- Data exporting

- Available in 5 languages

Pros

- Offers professional templates for invoice and estimation

- Provide a profit margin calculator

- Highly automated

- Ideal for frequent invoicing process

- Data security

Cons

- A free membership plan is not available

- Users can avail some features in premium plan

- Customer support is only available through Email

Pricing

- Essentials plan – $6.99 per month

- Plus plan – $13.49 per month

- Premium – $19.99 per month

10. Xero

Xero is another small business accounting software that works on cloud principle. It is ideal for small businesses and freelancers who need to manage accounts in simple form.

Its bank integration feature differentiates it from others. Using this feature, small business owners can integrate the platform with their bank accounts. This automates the sales tax calculation and simplifies the sales tax return.

Key Features

- Multiple plug-ins are available

- Supporting unlimited users

- Financial report tracking and generating

- Recurring invoice automation

- Inventory management

- Comprehensive project management

Pros

- Unlimited users and clients

- 30 days free trial

Cons

- No LIVE customer support

- Some features are available with the paid version only

- Pricing changes (recent prices are high)

Pricing

- Starter plan – $14.50 per month

- Standard plan – $23 per month

- Premium plan – $31 per month

11. Billdu

The other popular alternative to FreshBooks is Billdu, one of the popular invoicing tools. A user can simplify invoicing, estimates, and expense tracking. It offers customized templates to craft a professional invoice.

This billing software offers 30 days of cost commitment. It enables users to send the invoice in less time. Various features make this platform an ideal platform for business professionals.

Key Features

- Various online payment options

- Payment reminder feature

- Inventory management and tracking

- Recurring invoices

- Supporting multi currencies and languages

- Accessing data without an internet connection

- Managing multiple companies with a single account

Pros

- Highly customized to tailor the needs of your business

- Easy to use for the user

Cons

- Customer support is normal

- The free invoices can not changed once made

- The setup process takes a longer time

Pricing

- Free plan – $0

- Lite plan – $7.99 per month

- Standard plan – $14.99 per month

- Premium plan – $27.99 per month

Reasons to look for Alternatives to FreshBooks

No doubt, FreshBooks is one of the most popular software, still some limiting factors keep it back in the race. Here are a few reasons for other options –

- Lack of customization concept.

- FreshBooks user interface is less user-friendly.

- Lack of advanced features.

- FreshBooks is quite expensive for small businesses.

- The bank reconciliation feature is not available with the basic plan.

- Not providing quarterly tax estimates.

- It has a user limit policy which is an inconvenience for the business growth.

Get Paid Faster with Invoicing Solution of Moon Invoice

Enhance your business cash flow by creating accurate invoices like a pro.

What Should I Keep in Mind When Choosing FreshBooks Alternatives?

Whenever choosing the alternatives, you must focus on the following points.

1. Report Generation Feature

Generating financial reports is crucial for every business. Make it sure that your finalizing accounting software generates accurate reports. You should look for customization and export options in reporting. This simplifies the overall reporting process.

2. Scalability

You must opt for an online accounting tool that commits to scalability. However, it might be avoidable in the case of small businesses or freelancers but is an important factor for large enterprises. So one must look for scalability when choosing software.

3. Pricing

Pricing is crucial when you have a startup set up or are working as a freelancer. Have an eye on the available features in your chosen plan.

4. Support

Customer support is a key element when choosing invoice software. Not every person is friendly and experienced with every feature of the tool. Therefore strong support is necessary whenever an issue arises while using the tool. Make sure your chosen invoicing tool provides LIVE support through chat or call.

5. Data Security

Security of your data is always a first priority. Never make any compromise regarding security of data when choosing an accounting tool. Always check if the software provides data security or not.

Verdict

So we have shared and introduced you to numerous alternatives to FreshBooks available for businesses. Every software has its unique importance, so ensure it matches your business requirements.

It’s not necessary to choose highly popular and heavy-priced software but to opt for the best that matches your business needs. Happy Invoicing!