‘Invoice’ is the term often used when requesting money from a buyer. At first, the invoicing process may seem tedious because you need to do many things, such as manual calculations, maintaining spreadsheets, and issuing invoices to businesses in a timely manner. But, in reality, the tables have turned since modern tools and software were introduced.

The automated invoicing process outperformed manual invoicing in terms of accuracy, payment collection time, and customer satisfaction. There’s nothing wrong with creating invoices on paper, but following your business expansion, you may soon require all-in-one invoicing software to manage large invoice data.

Whichever method you choose will determine how quickly you get paid. As long as you want to create professional invoices and collect money on time, the automated invoicing process has an edge. Let us demonstrate to you how to create an invoice without getting tired.

Key Takeaways

- A professional invoice should include your business info, client details, itemized charges, payment terms, and due dates to avoid confusion or delays.

- There are multiple ways to create invoices for free, but the best option is to download free, customizable templates from Moon Invoice, built to your needs.

- Offer multiple payment options in your invoice; it will be easier for clients to make payments quickly.

- Well-organized invoices build trust and help reduce payment delays, which is why using proper templates and formats is key.

- Automated invoicing saves time. Using tools like Moon Invoice is faster and more accurate than creating invoices manually or on paper.

How to Make an Invoice in Easy Steps

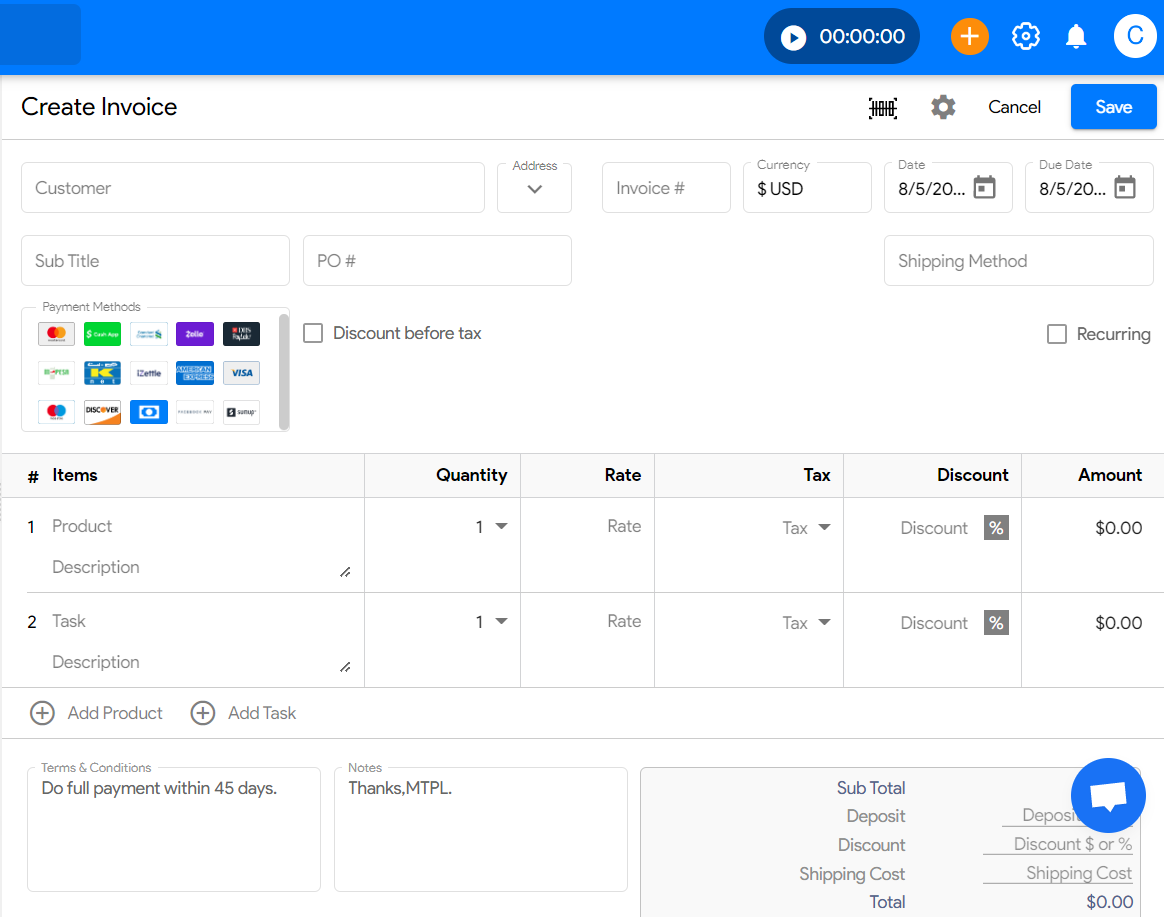

Invoices can be generated online using reliable software like Moon Invoice in just a few steps. Let us show you how to create invoices with an automated invoicing process.

1. Login to Moon Invoice & Go to ‘Invoices’

Unlock your smartphone and download the Moon Invoice app. Enter credentials to log in, or you can start a free trial. Opening the app, you’ll see a dashboard that showcases the history of payments and invoices. Go to the ‘Invoices’ from the main menu and click the “+” button to create a new invoice.

2. Put Business Details

Provide business details, such as your business name, office address, office contact number, and email address. You can even upload a business logo to highlight your brand on the top of an invoice. Also, it will help the recipient get in touch with you quickly if they have any queries and reduce the time it takes for payment.

3. Enter Clients’ Information

Clarify to whom the invoice is issued by typing the correct client’s name, address, email, and phone number. In addition, you must provide a unique invoice number along with the issue date. Make sure every detail you enter is correct before proceeding, as an invoice will be stored in the financial records once it is generated.

4. Add Payment Methods

Attach a payment link or offer online payment modes to help clients make quick payments. You can also collect money by cash payment if the client wants to pay offline. Notably, Moon Invoice consists of 20+ payment methods, from which you select the most preferred method by your client.

5. Furnish Products & Costs Details

Next, list out the services you offered or the number of products you delivered, including their quantities and rates. If needed, you can also write a short description of the products or services. Following that, you can even select the applicable taxes from the drop-down menu to comply with local tax laws.

6. Review an Outstanding Amount

As soon as you enter the cost of the product or service, the total outstanding amount will appear automatically. Review it once to make sure you didn’t miss out on anything. Recheck if the added taxes align with your business requirements. That’s how it eliminates manual calculations.

7. Specify Terms & Conditions

Now, elaborate on the payment terms and conditions to let your clients know how soon they need to make payments. Representing payment terms clearly will make sure you have no disputes and facilitate timely payments. Include the late payment charges as per your business’s policy.

Level Up Your Invoicing Game With Moon Invoice

Automate your invoicing process with Moon Invoice and stay on top of your invoicing game.

How to Create an Invoice for Free

There are three ways you can create an invoice at no cost. Based on your invoicing requirements, you can choose any one of them.

1. Create an Invoice on Paper

If you want to create free invoices, making paper-based invoices can help you bill your clients without incurring extra costs. However, it doesn’t guarantee professionalism, and the quality of an invoice may deteriorate. Paper-based invoices are free, but can lead to payment delays as they are difficult to understand at a glance.

2. Using Google Docs

In case paper-based invoices do not work for your business, get ready-made templates from Google Docs. You don’t need to pay money to use Google Docs invoice templates. Use it for free with your Google login credentials and start making an invoice. It is a complete paperless process, but lacks customization options.

3. Using Online Invoice Templates

If the above two options fail to meet your invoicing requirements, you can switch to Moon Invoice and download fully customizable invoice templates for free. The software provides over 66 pre-built invoice templates to align with different business requirements, ensuring you create an invoice with a professional touch that encourages timely payments.

💭DID YOU KNOW?

According to a survey by Fundbox, 64% of small businesses regularly deal with late payments, and it takes an average of 21 days to get paid after the due date. That’s nearly a full month of cash flow disruption!

What is Included in an Invoice?

Here are some must-have elements to include when creating an invoice from scratch. Let us know what they are.

Invoice Date & Number

The invoice date and a unique invoice number should be on every invoice, whether you create it online or offline. They will simplify managing your financial records.

Due Date

An invoice is incomplete without the due date. You need to add the correct date, so the recipient is informed of the payment deadline. Once the due date has passed, penalties may be incurred.

Total Pending Amount

It is important to enter the total pending amount in such a way that it grabs the client’s attention easily. Double-check the amount you enter if you’re creating an invoice manually.

Payment Link

Attach a payment link or give online payment options according to the client’s preferences. By doing so, the client may process the payment more quickly.

Additional Notes

Notes are optional, but if you want to ensure there are no communication gaps or disputes, outlining additional notes is essential.

Owner’s Signature

Add the business owner’s signature or the business stamp to confirm that your business officially issued an invoice.

How to Handle Late Payments?

Even with the most organized invoicing process, late payments can happen. Whether it’s a missed email, a busy client, or a simple oversight, it’s something most businesses and freelancers face at some point. But don’t worry—there are smart ways to deal with it without damaging the relationship.

1. Set Clear Expectations Upfront

Before you even send an invoice, make sure your payment terms are crystal clear. Include due dates, late payment fees (if any), and accepted payment methods directly on the invoice. When you’re creating invoices for businesses, this transparency helps avoid misunderstandings.

2. Send Gentle Reminders

If the due date has passed and you haven’t received payment, don’t panic. A polite reminder email works wonders. Most people appreciate the nudge. Keep it friendly and professional—sometimes, a quick message is all it takes to get things moving.

3. Automate Follow-Ups with Invoicing Software

Using software like Moon Invoice lets you schedule automatic reminders for unpaid invoices. This is especially helpful if you’re juggling multiple clients. For growing businesses, automating follow-ups ensures you stay on top of payments without spending extra time on manual tracking.

4. Offer Flexible Payment Options

Sometimes, a late payment happens because the client couldn’t pay through the available methods. When creating invoices for businesses, offering multiple options, like credit cards, bank transfers, or online wallets, can speed up the process and prevent delays.

5. Add Late Payment Fees

If late payments are a recurring issue, consider including a small late fee in your payment terms. Just make sure it’s communicated clearly in advance. This can act as a motivator for clients to pay on time.

6. Know When to Escalate

If follow-ups aren’t working and the payment is significantly overdue, it might be time to escalate—either by sending a formal notice or working with a collections partner. Keep a record of all communication and copies of invoices for businesses to protect yourself legally.

💡Pro Tip:

Always include a clear due date and payment instructions on every invoice. If you’re sending invoices for businesses regularly, use invoicing software that lets you track when a client opens your invoice—this helps you follow up with more context and get paid faster.

What’s the Proper Invoice Format?

A proper invoice format follows a standard structure, ensuring that business and invoicing details are clearly highlighted while maintaining a professional touch. It is essential to enter these details accurately to avoid unnecessary back-and-forth.

Additionally, display the total amount due along with the due date clearly. At the bottom, include the necessary payment terms or instructions. For convenience, you can use ready-made invoice templates that eliminate the need for designing and formatting.

Download an invoice template in any format from Moon Invoice and fill in the required details to create a professional invoice in minutes.

List of Free Invoice Templates

Borrowing an invoice template isn’t a big deal. You can download it from the invoicing software, Moon Invoice, and prepare a beautiful invoice. Here, we have a list of free invoice templates, from which you can pick the ideal one.

- Contractor Invoice Templates

- Auto Repair Invoice Templates

- Freelancer Invoice Templates

- Hotel Invoice Templates

- Medical Invoice Templates

- Small Business Invoice Templates

Create Professional Invoices On the Go

Choose a pre-designed invoice template from Moon Invoice and create a professional invoice from anywhere.

Conclusion

To sum it up, as mentioned there are two ways on how do you do an invoice. Undoubtedly, the automated invoicing process has a clear edge in terms of professionalism, accuracy, and payment times. A few steps are all it takes to generate an invoice using automation tools like Moon Invoice.

Plus, you can even create an invoice by getting customizable invoice templates for free. These aforementioned steps will help you speed up the invoicing process and can expect payments on time. In case you want to try it by yourself, we recommend you start using Moon Invoice.