Firms often experience erratic cash flow. However, firms and their managers might be troubled when dealing with inconsistent cash flow and inadequate reserves. Growing companies, particularly those in the business-to-business (B2B) sector that relies on credit terms, usually like clients who may have 45, 60, or 90 days to pay, typically confront this dual difficulty. When customers pay late, it may strain a company’s cash flow. Therefore some choose to use invoice finance to convert their accounts receivable into immediate funds. Invoice financing might be a viable option for businesses that have trouble securing bank loans or credit lines.

Companies may use invoice financing to get short-term loans based on their outstanding invoices. If you’re having trouble making ends meet, have unexpected costs to cover, or weren’t approved for a traditional small business loan. This sort of financing may be for you.

How it works and where to acquire it for your company are discussed in detail regarding invoice financing.

What is Invoice Financing?

Invoice financing allows small business owners to get a cash advance on their unpaid bills to customers. Accounts receivable financing, or invoice discounting, is another name for this form of a company loan.

Your outstanding invoices are used as collateral when you get invoice financing. In this sense, invoice financing may be more accessible than other forms of small-business lending, but at a greater cost. You are still legally accountable for any unpaid invoices that are yours to collect.

Loans and lines of credit, sometimes known as accounts receivable lines of credit, are both viable options for financing invoices.

How Does Invoice Financing Work?

Three parties are involved in an invoice financing arrangement: the firm issuing the invoice, the client receiving the invoice, and the financial services provider. Suppose a firm wants to get the most out of accounts receivable financing. In that case, it has to work out favorable conditions with the financing provider and hope its client pays before the invoice’s due date.

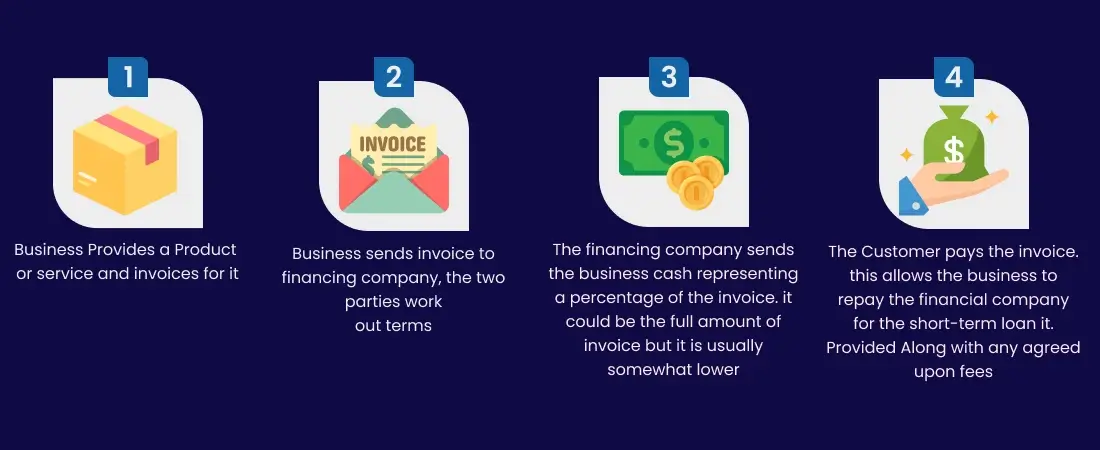

The procedures involved in invoice financing are laid out in the following chart.

Lenders provide funding for a portion of your outstanding invoices, sometimes up to 90%. After deducting the service charge and the company’s cut, the remainder is yours to keep after the consumer pays the bill.

Invoice financing companies may impose various fees, the most common of which is a percentage generally between 1-5% of the total invoice amount.

One illustration of invoice financing in action might be as follows:

Receive Funding

To illustrate, imagine you need to finance a $500,000 invoice with terms of 45 days. You get an advance from the finance business equal to 90% of the total amount ($450,000).

Fees Charged

If your client takes longer than a week to pay the bill, the business will assess a 2% late fee. If the consumer takes two weeks to pay, you’ll have to fork out $18,000 to the lender in interest charges (2 percent of $500,000 divided by $9,000 each week).

The borrower is repaid once you receive the payment

Once the consumer has paid the invoice, you will give the lender $468,000 (the initial advance amount plus costs).

Types of Invoice Financing

Accounts receivable lines of credit and invoice factoring are two kinds of invoice financing which are generally used in the market.

Credit Line for Receivables

Lines of credit secured by unpaid invoices are called accounts receivable lines or invoice financing. Invoices serve as collateral for this line of credit, and the amount you may borrow is often up to 85-90% of the invoice value.

An accounts receivable line of credit is similar to any other company line of credit in that it allows you to draw funds as required rather than receiving a lump sum equal to the number of your bills up front, like with conventional invoice financing or invoice factoring.

A line of credit secured by a company’s accounts receivable allows the borrower to receive funds while charging interest only on the amount used. Additionally, some lenders may charge a draw fee each time you use your credit line.

Accounts receivable finance is similar to traditional invoice financing in that you retain the invoices and are charged with collecting revenues from clients which opposite of invoice factoring.

Invoice Factoring

Although invoice factoring and invoice finance are sometimes used interchangeably, they are distinct forms of financing with advantages and disadvantages.

In conventional invoice finance, you must pay back the borrowed money plus interest. Selling your unpaid bills to a third party at a discount is called ” Invoice factoring.”

One benefit is that it frees up staff time formerly spent on tedious collections processes in firms. However, this strategy has the potential downside of giving up oversight over a crucial connection with a consumer.

Because of this, invoice factoring companies will often be the ones to pursue payment from your clients.

Pros and Cons of Invoice Financing

Pros

You may use invoices as collateral

Invoice financing is an alternative to traditional business loans that may be more accessible since your company’s invoices secure them.

A Financing company often takes your clients’ repayment track record into account when determining your eligibility, so even if you have a low credit score or run a startup, you may still be able to get financing.

Rapid funding

Most invoice financing companies have straightforward applications requiring little paperwork and giving cash in at least 24 hours.

When you need money fast, as in an emergency or because of a cash flow problem, the rapid financing method may help.

It’s perfect for B2B and seasonal businesses.

Since outstanding invoices are required to secure money, invoice financing is most useful for organizations that interact largely with other businesses. If unpaid invoices are causing cash flow issues for your business, you may want to look into invoice financing.

Cons

Commercial transactions only

This form of funding is significantly less likely to be available to firms that sell directly to consumers because of the fast payment terms that such enterprises often demand.

Dependence on sales revenue

Considering that the costs you incur for invoice financing are calculated depending on how long it takes your client to pay the invoice, it might be difficult to predict the whole cost of this method in advance.

An invoice financing company may impose late or extra fees if your client is late or skips a payment. When a client stops paying, your risks increase.

Financing costs can be proven high at times

While the expenses associated with invoice financing, which are usually 1-5% of the total invoice amount every month, may seem affordable at first glance, they may add up to an APR of as much as 79%. Contrast that with the average annual percentage rate (APR) on a Small Business Administration loan, which is between 5.50 and 8 percent.

Invoice Financing Vs. Invoice Factoring

Unpaid invoices may be converted into cash via invoice financing or invoice factoring.

| Invoice Financing | Invoice Factoring |

|---|---|

| Invoice financing is similar to a typical private loan in that it has specified payment terms and accrues interest on outstanding balances, but invoices are used as collateral instead. | In invoice factoring, the cash received by the firm is not a loan. Rather, a factoring business, often known as a factor, “buys” the invoice and accepts collection obligation. |

| With invoice financing, you retain control over the invoices and continue to work directly with clients. You get all or a part of the money from the lender in advance. When your client settles the invoice, you get the remaining amount less any lender costs you agreed to pay. | With invoice factoring, you sell your invoices at a discount to a factoring business. The factoring business pays you a percentage of the invoice’s total amount and collects it. After receiving payment from your client, the firm delivers the remainder of your payment, less agreed-upon costs. |

| Suppose a firm prefers to keep control of its bills and deal directly with its clients. In that case, invoice finance is typically the best solution. | Suppose you are willing to relinquish control over your bills and have faith in the factoring company’s ability to treat your clients with courtesy and professionalism. In that case, factoring may be a superior option. |

Example of Invoice Financing

It’s the first of the month. Make-believe baby products manufacturer Joseph has just delivered a $100,000 contract to a retail chain. Due to the retailer’s payment conditions of 30 days, Joseph is aware that it will soon run short of cash. Therefore, Joseph should contact a business that occasionally funds its bills after delivering the invoice to the retail chain.

The financing company has told Joseph that it may receive a wire transfer of $80,000, or 80% of the invoice total. A 2% loan origination fee will be levied, along with a 1% weekly factor fee until the invoice is paid in full.

Joseph must pay 3% interest on the $80,000 since the store doesn’t pay until 21 days after receiving the invoice. Totaling $4,000. This includes $1.600 in processing fees and $2.400 in interest owed by Joseph to the invoice factoring company.

After receiving the payment, the clothing manufacturer sends $84,000 to the lender through a wire transfer.

How to Qualify for Invoice Financing?

Accounts receivable from reliable, timely-paying clients are a prerequisite for receiving invoice financing. The company should also be aware that the financing company will likely check its personal credit and company essentials even if this is not the financing company’s major concern.

A business owner with a low credit score may have problems securing financing from certain institutions. A poor credit score may also lead to increased interest rates, application fees, and other financial costs.

How to Apply for Invoice Financing?

Get in touch with a reputable lender and get your application in motion if you believe invoice financing may work for you.

Fortunately, the application process for invoice financing is often quick and easy, particularly when compared to more conventionally structured loans.

As we’ve already mentioned, the most crucial aspect of your application will be your invoice(s), as these will influence the size and conditions of the financing you’re offered.

However, some lenders may demand you provide more details about your company and its finances.

- Valid driver’s license

- Invalid company check

- Financial records for a company

- Accounting records for a company

- Credit ratings for individuals and companies

A typical application for invoice financing may be finished in about ten minutes when done online. To this aim, several organizations facilitate incorporating third-party applications, such as accounting programs, into their system.

There are a lot of invoice financing companies that may give you an offer and get you the money within a week or less.

Conclusion

Many B2B companies have erratic cash flow, particularly if they have slow-paying clients or prolonged payment terms. Companies in this condition that do not have a sizable bank account are occasionally cash-strapped.

Invoice financing might be a viable alternative if they do not have access to conventional bank loans or credit lines. In invoice finance, a firm that needs cash quickly utilizes part of its invoices as collateral to get more money from a company that offers short-term financing.

Although invoice financing is a rather costly form of acquiring capital, it is typically employed by developing organizations to fund near-term operational needs or seek development prospects.