Invoice and receipt are two common terms that you may have heard while you are dining out, shopping, or managing business payments. “I didn’t receive an invoice”, “I paid, give me a receipt” are some common things that business owners encounter on a daily basis. An invoice and a receipt differ from each other, but both are important not only for filing tax returns but also to keep you on top of the financial management.

No matter how many invoices and receipts you generate, you need to keep all of them in financial records. Invoices will help you with payment tracking while receipts show the bigger picture of the business’s financial health. If you are unsure when to use a receipt or invoice, here we have a complete guide on the difference between invoice and receipt. Also, understand how Moon Invoice can play a pivotal role in creating paperless invoices or receipts quickly.

What’s the Difference Between Invoice and Receipt?

An invoice and a receipt not only have a different purpose but also their time of generation is completely different. Let’s explore invoice vs receipt to understand their distinctions in detail.

The time of payment

An invoice is created to request the payment, which means it will be issued prior to the payment. In contrast, a receipt is issued only once the customer has successfully completed the payment and there are no more pending dues. An invoice can be sent to the buyer in order to demand the money for the goods delivered. So, the buyer is yet to make the payment when an invoice is issued. On the contrary, a receipt is made when the customer pays the total amount mentioned on an invoice.

Purpose

An invoice is used to help customers know the money they owe to you. On the other hand, a receipt is created when you get paid. Invoices can be used to track the status of the payment. Unlike invoices, receipts can’t be used to track the payments, but they help you revise business strategies and ultimately, improve the cash flow.

What is an Invoice?

An invoice is a formal document to demand payment for goods or services you already provided to the buyer. It comprises important details like pending amount, due date, or any other payment instructions. An invoice helps your customers know how much money they owe to you.

Once you share an invoice, the buyer needs to complete a payment in the given timeline. If they fail to pay on time, you can add late fees to the total outstanding amount in an invoice. You need to save every invoice copy in such a way that you should be able to track payment easily.

How to Write an Invoice Professionally

The best way to write a professional Invoice is by using the powerful invoicing software, Moon Invoice rather than generating hand-written invoices. The software makes sure you prepare an attention-grabbing invoice in less time. Let’s understand how to do that.

- Login to the Moon Invoice or Sign up for free and start creating an invoice from the “Invoices” tab.

- Now fill in the customer details like full name, billing address, contact number, or email. These details will be automatically saved for future purposes.

- Then, enter the invoicing details like invoice number, currency, issue date, due date, and then select the preferred payment method.

- Next, you can add product details, including their rates and quantities. For service-based businesses, you can add multiple tasks.

- Include discounts or select taxes if applicable, and it will automatically adjust the total outstanding amount.

- Later, you can mention additional notes, attach files if required, or highlight payment terms and conditions.

- Thereafter, hit the ‘save and preview’ button to save changes and review an invoice. Open a preview and check if everything is correctly mentioned.

- Send an invoice directly via Email or WhatsApp. If needed you can take a normal print or thermal print as well.

Here’s a perfect invoice example

Create Invoices That Get Paid Faster

Let Moon Invoice generate paperless invoices with readymade invoice templates and help you get paid 2x quicker.

What is a Receipt?

A receipt is a formal document acknowledging that the payment has been made and there are no pending dues. It usually works as payment evidence to confirm that payment is made. It consists of the product’s quantity, including its rates and the payment method. Businesses can only issue a receipt once they have received the payment.

Just like invoices, receipts should be stored in handy tools for analyzing the cash flow and adjusting the pricing strategies. Businesses can use receipts to settle disputes, while clients can utilize receipts to meet their tax obligations.

How to Write a Receipt

With technological advancement, software like Moon Invoice has made receipt generation simple and easy. You can generate accurate receipts in no time. Follow the below steps to create a receipt.

- Open the Moon Invoice app using your credentials or sign up free on the web app. Find ‘Sales Receipts’ in the menu options on your left side.

- Enter customer details like full name, delivery address, contact number, or email. Details once entered will remain saved on the Moon Invoice.

- Thereafter, put invoicing details like currency, date of payment, and payment method used by your client.

- Next, include product details, delivery address, delivery time, or tasks completed, including their short descriptions.

- Specify product or service cost, discount offered, or taxes applied and let Moon Invoice calculate the total paid amount automatically.

- You can even put additional notes If required, or highlight your company’s refund policy.

- Save changes and tap on the ‘preview’ button to know how it will look. Thoroughly check the details on the receipt.

- Once the receipt is generated, you can send it digitally to clients via WhatsApp or Email.

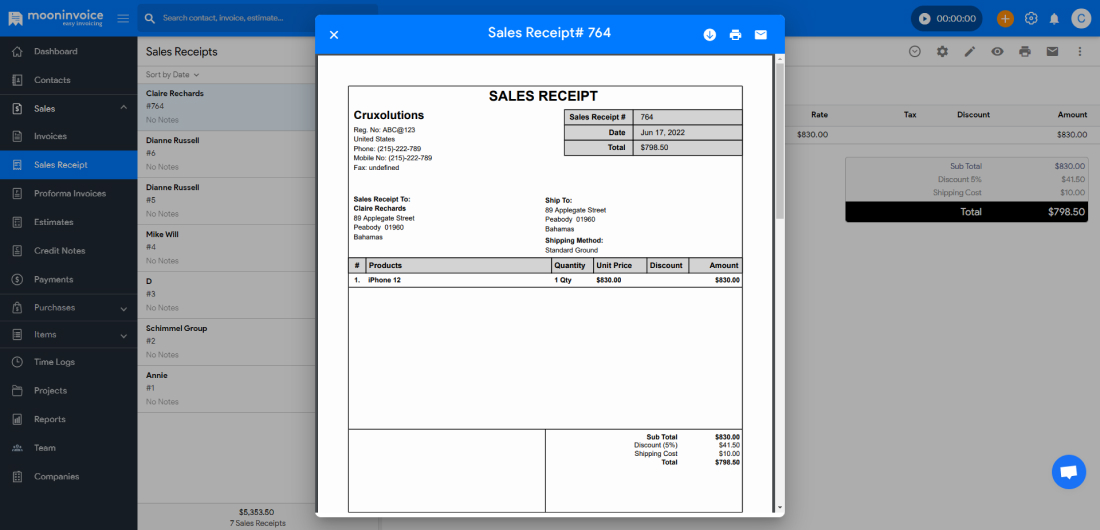

Refer to the receipt example below for more clarity.

Importance of Invoices and Receipts in Business

Issuing invoices and receipts is important for service-based businesses as well as for those who sell products. Let’s find out why they are so vital.

1. Financial Records

Your financial records are nothing without invoices and receipts. Whether you issue an invoice or generate a receipt, you need to make sure you store each of them properly. Or else, you can simply hand them over to the accounting team so that they can update the accounts receivable and accounts payable sheets. Maintaining financial records with invoices and receipts means you can monitor the incoming cash flow and analyze the business profits.

2. Tax Obligations

Surviving the tax season is another reason why you must save an invoice or receipt. If not saved, you may need to collect each of them from every corner, consuming a lot of time just filing your tax returns. Therefore, it is better to keep invoices and receipts stored in the cloud-based invoicing software to quickly file returns using accurate data. A minute or two is what the right invoicing software takes to generate tax reports if you store invoices and receipts digitally.

3. Claim Deductions

With invoices and receipts stored in handy tools, you can easily figure out whether you can claim deductions. Invoices and receipts help you prepare a tax report and can be used as supporting documents while submitting the claim to the IRS. This way, you can save hefty money by submitting receipts that prove the money was used for business operations and not for any other purpose.

When to Use Invoices and Receipts?

As soon as you deliver a product to the customer’s location or complete the service, create and share an invoice. Sending an invoice after the delivery or service is the right time to demand money from customers. It shows how professionally you provide services and handle the invoicing process. Issuing an invoice timely could also attract payment quickly, reducing the number of unpaid invoices. Hence, remember you always need to share an invoice prior to the payment.

Receipts should only be generated if you have received the payment. Therefore, once the customer pays the due amount, you need to make a fresh receipt. Ensure you include the paid amount, the correct date, and the payment method when you create a receipt. Later, hand it over to the customer. The given receipt will serve as proof of payment. This is how the receipt is used only after collecting payment.

Is an Invoice and a Receipt the Same?

No, an invoice and a receipt can never be the same. A business owner issues an invoice for whatever they delivered either goods or services. Whereas receipt is only provided if the customer has successfully paid their dues.

An invoice outlines the cost incurred and how much money the customer owes to the company. On the other hand, the receipt is sent to confirm the payment is made.

Therefore, there are no similarities between an invoice and a receipt, both are distinct from each other.

Manage Invoices and Receipts From Anywhere With Moon Invoice

Moon Invoice, an online invoicing software, has made it easier to manage your business finances. Whether it is an invoice or a receipt, you can store unlimited copies in the software. Interestingly, it provides ready-to-use invoice templates and receipt templates that need no extra work. You can pick a template in any format, enter details, and save changes to create a professional invoice or receipt instantly rather than making hand-written receipts on paper.

Here’s how you can transform your business using Moon Invoice.

✅Impress clients with attention-grabbing invoices

✅Manage business finances efficiently

✅Scan financial reports on the go

✅Store receipts in the cloud storage

✅Track business expenses seamlessly

✅20+ payment integration to help you get paid

Manage Business Finances Without Lifting a Finger

Get Moon Invoice to keep your finances well organized and stay on top of your financial management.

Conclusion

Receipt vs invoice, in a nutshell, are quite different from each other as both serve different purposes. But they are crucial as long as you want to operate your business legally and deliver invoices professionally. Apart from the invoicing process, they make it easier to track payments and make important financial decisions.

Since you know the difference between an invoice and a receipt, you can easily create anyone using the above-mentioned steps. On a conclusive note, we recommend you try Moon Invoice to manage invoices and receipts efficiently on a cloud platform rather than doing tedious paperwork.