Fundamental accounting principles are a set of guidelines that govern a company’s accounting process. To ensure consistency and accountability, all accountants must adhere to these standards while doing their duties. Certain countries adhere to particular standards, but some laws also follow global standards.

When you practice accounting, you must have a basic grasp of these main accounting concepts. However, it isn’t easy to remember and may vary according to your region. That’s why choosing accounting software for financial services is the best bet for conducting a seamless accounting process.

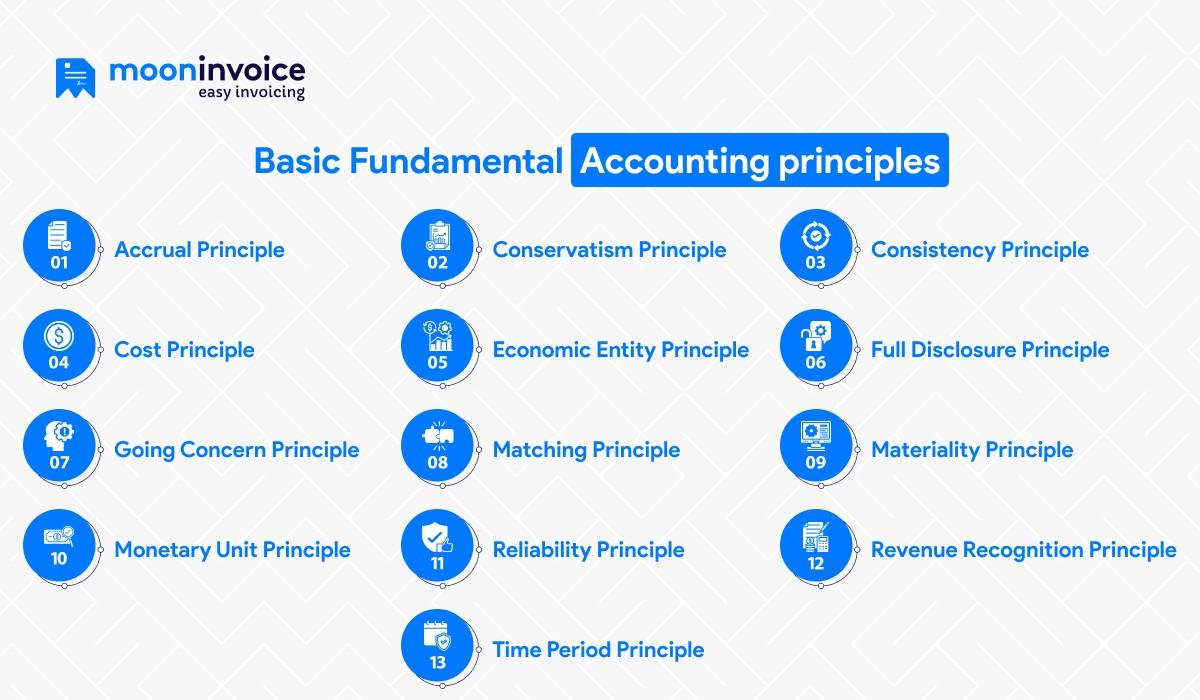

Let’s dive deeper into 13 accounting concepts and discover the basic principals of accounting to consider.

📌 Key Takeaways

- There are 13 basic accounting principles and concepts (like accrual, matching, and revenue recognition) that help keep financial reporting accurate, consistent, and fair — often referred to as GAAP.

- Using accounting software that follows these principles can simplify compliance and ensure clean, organized financial records for small businesses.

- These fundamental principles of accounting guide how to record revenue, expenses, and assets.

- These accounting principles and practices bring clarity and transparency, helping in business management, investor trust, and avoiding legal issues.

- GAAP and IFRS are two major frameworks; GAAP is more rule-based (used mainly in the U.S.), while IFRS is more principles-based (used internationally), but both enable reliable, comparable reporting.

What are the Accounting Principles?

Principles of accounting refer to the rules that should be followed when drafting financial statements, which are later shared with stakeholders or lenders of the company. These principles include the cost principle, the matching principle, revenue recognition, and many more. These principles direct accountants while making income statements or any other financial statements. Sometimes also known as generally accepted accounting principles (GAAP), these principles highlight the guidelines applicable to different topics.

💡A Must-Know Fact:

Your taxes could look a bit different in 2026 because prices are not changing much, and your tax slabs might go up slightly, as per Bloomberg Tax & Accounting.

Basic Fundamental Accounting principles

Here are some of the most widely recognized fundamentals of accounting, along with their accounting principles examples to use while performing your accounting duties.

1. Accrual Principle

The accrual theory in accounting states that all expenses should be recorded in the amounts they occur, no matter when the transaction happened. This theory is especially relevant in accrual accounting since it allows for creating more detailed financial records that demonstrate what changes occurred over time.

So, when you are using online accounting software, you must be aware that to record a transaction, it is not necessary to check whether it is paid in cash or not. If an entity does not adhere to the accrual concept, the resulting cash flow can cause the transaction to be artificially accelerated or delayed.

- Example: Imagine you provide graphic design services in March but don’t get paid until April. Under the accrual principle, you still record the income in March, because that’s when the service was delivered.

- Why it matters: Helps match income with the actual work period, not just payment timing.

2. Conservatism Principle

The conservatism philosophy explains that expenditures and liabilities should be reported as soon as practicable. In contrast, profits and assets should be registered only after an accountant is confident they will arise. As an SME owner, you must check that your invoice-creating software is built on this fundamental because expenses are always crucial to a business.

Using this idea will skew financial statements in a conservative direction, resulting in lower estimated earnings due to asset and revenue identification delays.

- Example: Let’s say your company might face a lawsuit. Even if you’re not 100% sure you’ll lose, you should record a possible liability just in case. But if you expect a big client deal, don’t record that income until it’s confirmed.

- Why it matters: It keeps your financials on the safe side—better to understate than overstate earnings.

3. Consistency Principle

The consistency principle is all about adopting one accounting system for your company consistently for accounting practices and preparing financial statements. If the accuracy theory is properly and narrowly followed, there are many advantages for financial statements, which are later shared with stakeholders. That applies to the use of small business financial reporting software. Software that follows the consistency principle will simplify things for you.

- Example: If you start using straight-line depreciation for your equipment this year, stick to that method next year too—don’t switch unless there’s a good reason.

- Why it matters: It helps maintain comparability across financial reports over time.

4. Cost Principle

This accounting principles rule states that a company can report all equity contributions, profits, and liabilities at their initial purchasing prices. This principle says that the quantities reported cannot be modified for market value increases or inflation. The exception to this rule is when a short-term transaction in a corporation’s capital stock changes in market valuation. However, this exception only happens if the securities are publicly traded on one international stock market. You need to make sure that accounting software helps you prepare accurate statements.

- Example: You buy a delivery van for $25,000. Even if its market value goes up later, you still report it at the original cost unless it is sold or revalued under specific rules.

- Why it matters: It keeps your books based on factual, verifiable transactions.

5. Economic Entity Principle

According to the Economic Entity Principle, a company’s operator has separate legal liabilities. The company must distinguish all purchases from its owners, shareholders, and other businesses. This means that the transactions reported in the entity accounts are just those belonging to the entity.

For example, let us say you own a coffee shop. One day, you take a bag of coffee beans home for personal use. Since this is not related to your business operations, it should not be recorded as a business expense. To maintain accurate records, your billing software must treat the coffee shop as a separate entity.

- Example: You own a bakery and take home some flour for personal baking. That transaction shouldn’t be recorded as a business expense.

- Why it matters: Keeps personal and business finances separate—super important for clean books.

6. Full Disclosure Principle

The full disclosure principle demands that the company reveal all necessary information in its financial report. This is to ensure that it gives a magnified view of the company’s financial condition. As a result, it is essential to ensure that they have access to all relevant material using accounting software for financial services. You should obey each accounting requirement regardless of whether the condition that occurs in your entity should be revealed or not.

- Example: If your company is going through a major restructuring or has pending litigation, you must mention it in your financial notes—even if the numbers don’t reflect it yet.

- Why it matters: It gives stakeholders the full picture, not just the surface numbers.

Financial Reports Now at Your Fingertips

Generate accurate financial reports using Moon Invoice and prepare income statements as quickly as possible.

7. Going Concern Principle

Going concern is the term that assumes the business will continue to run, usually for twelve months from the operation date, if the financial accounts are compiled based on a going concern. This principle impacts the decision on equipment depreciation or amortization as it considers that the business will not liquidate its assets, no matter what. With the going concern principle, the company is not required to liquidate investments as it assumes they will operate continually.

- Example: You buy equipment assuming the business will operate for several years. If you were planning to shut down next month, you’d need to record assets differently (possibly liquidated values).

- Why it matters: Assumes stability in business operations unless there’s clear evidence otherwise.

8. Matching Principle

The matching theory also called as expense recognition theory is an accounting principle that governs how costs and receipts are recorded and recognized in financial statements. It ensures that profits and liabilities in the income statement are accurately measured in the timeframe. When this principle is followed correctly, net profits appear in the income statement indeed and equitably, not due to an overestimation or underestimation of sales or expenditures.

- Example: You pay an annual software license fee in January for use throughout the year. Spread the expense over 12 months, not just January.

- Why it matters: Matches costs with the revenue they help generate, improving profit accuracy.

9. Materiality Principle

It indicates that important financial details leading to decision-making must be recorded and reported correctly. The materiality principle helps businesses determine what information should go into their financial statements based on how much it could matter to others. Recording material incorrectly will further contribute to the wrong decisions.

For example, if a company spends a large amount of money on something unusual compared to its regular income, this should be shown separately in the financial report. This way, stakeholders will be able to better understand how it affects the company’s finances.

- Example: If your business earns $5 million a year and spends $30 on a wall clock, you don’t need to over-document it. But a $50,000 software purchase? Definitely needs its own line item.

- Why it matters: Focuses attention on financial details that could influence decisions.

10. Monetary Unit Principle

You must include transactions only when they can actually be expressed in monetary terms. So, it keeps the records simple and easy to understand by showing everything in a consistent money format. For instance, if the company buys a commercial building, you must record the paid amount instead of mentioning the size and amenities. This is how you should double-check if every record is expressed in currency and not in other terms.

- Example: You buy a company car—you record the cost ($22,000), not its horsepower, color, or comfort features.

- Why it matters: It keeps records focused on measurable monetary values.

11. Reliability Principle

The reliability principle states that the entered information should be facts and not related to any personal use. This is because to maintain accuracy in the reports, you must have valid proof whenever the financial entry is made. Let’s say you report $3500 as an employee’s meal expense; then you must also attach relevant documents. Likewise, you must follow a similar process if you list out accommodation or transportation costs when generating reports.

- Example: You can’t just estimate that you spent $2,000 on team lunches. You need receipts or bills to back it up before entering it into your accounting system.

- Why it matters: It ensures all recorded data can be verified and trusted.

12. Revenue Recognition Principle

As its name suggests, revenue should be recorded only when you earn it and not when the cash comes in. In other words, the business should record revenue once the delivery of the product is complete, no matter whether the amount is paid or not. This accounting practice displays the company’s accurate earnings for a specific period. Assuming you completed furniture delivery in August but got paid in September. As per the revenue recognition principle, you must record the revenue generated in August.

- Example: You sell and ship a batch of chairs to a client in August, but they pay you in September. Record the income in August when the chairs were delivered.

- Why it matters: It reflects income based on actual service or product delivery, not payment timing.

Bonus Tips: What Does Year to Date (YTD) Stand for?

13. Time Period Principle

The time period principle states that reports should comprise the exact time in order to maintain comparability. It allows businesses to efficiently manage records in the ledger and simultaneously compare them to gauge their performance. For instance, if your company prepares the financial report starting from April 1st to March 31st, then you must ensure that all expenses incurred during this period are recorded.

- Example: Your fiscal year is April 1 to March 31. If you earn or spend anything during that time, it must be recorded within that same window, even if the invoice was paid later.

- Why it matters: It keeps financial statements organized and comparable across periods.

💡Pro Tip:

If you’re using accounting software, make sure it allows for customizing reporting periods and supports both cash and accrual accounting. This will help you easily follow principles like Matching, Time Period, and Revenue Recognition without making manual adjustments, saving time and reducing errors.

Why Is Financial Accounting Important?

Financial accounting is crucial not only to survive tax season but also for various other reasons. Below are some reasons why financial accounting matters for your business.

1. Budget Plan

Keeping track of finances means you can identify your cash flows and financial position, helping you create an efficient budget plan for next year. Analyzing accounting metrics can help you cut down unnecessary business expenses and ensure you accomplish desired profit goals. It also helps you set up competitive prices to ensure your business thrives.

2. Financial Reporting

Businesses need to record accounts payables and accounts receivables to prepare income statements, which can be used to report to governing bodies. Therefore, you must ask the accounting team to keep a tab on the cash flow and update the spreadsheet accordingly. Remember, your statement should align with the principles of financial accounting, or else you might face penalties that further impact your budget plans.

3. Drawing in Investors

Financial accounting is also important for attracting investors and raising funds for your company, helping you achieve organizational goals. Investors often scan a company’s financial reports before they invest. They use these reports to assess the company’s financial health, as they expect high returns on investment (ROI).

Importance of Principles of Accounting

While complying with accounting rules may seem difficult, adhering to accounting principles is important for several reasons.

1. Financial Analysis

Companies follow accounting principles to make important statements and determine their net income and expenditures during a fiscal year. This practice is also essential to identifying liabilities incurred by the company. By following accounting principles, businesses get a bigger picture of their financial condition and can determine whether they are on the right track.

2. Cross-comparison

Considering accounting principles helps businesses cross-check their data to know whether it meets the guidelines. The accounting team conducts quick comparisons to ensure compliance with these principles, helping the company avoid potential penalties and maintain regulatory standards. Such financial practices will also aid in impressing investors or lenders.

3. Transparency

Adhering to accounting principles can offer transparency in your accounting process, making it easier to determine red flags and tackle fraudulent activities. It promotes transparency in such a way that you can avoid misunderstandings and improve credibility by offering a clear and accurate financial picture to anyone outside the company.

How Do Accounting Principles Work Under GAAP and IFRS?

Accounting principles under GAAP and IFRS aim to combat irregularities and facilitate data management. They can also be used to discover investment opportunities abroad as accounting principles align with international standards. Here, let’s understand how accounting principles work under GAAP and IFRS in detail.

| GAAP | IFRS |

|---|---|

| It defines at what time revenue can be recorded. | It observes control for the transfer of goods. |

| Specifies when business expenses should be compared with the company’s income. | Outlines the match of expenses with revenue output. |

| GAAP highlights guidelines for recognizing a company’s liabilities. | IFRS offers general guidelines rather than defining rules. |

| It describes the accounting standard for investments. | It prefers the equity method as far as investments are concerned. |

Make the Accounting Process a Breeze With Moon Invoice

Utilize Moon Invoice to manage important accounting & invoicing documents in the cloud to simplify the accounting process.

Common Mistakes to Avoid When Applying Accounting Principles

Even with the best intentions, businesses often make avoidable mistakes that lead to messy books, inaccurate financial reports, or even compliance issues. Here’s a breakdown of common errors tied to each fundamental principle, along with what to watch out for:

1. Accrual Principle Mistake

- Mistake: Only recording transactions when cash is received or paid.

- Fix: Always record income and expenses when they *occur*, not when money changes hands. Otherwise, you’ll end up with inaccurate profit reporting.

2. Conservatism Principle Mistake

- Mistake: Recognizing potential revenue too early or downplaying risks.

- Fix: Only recognize profits when they’re certain. Record losses as soon as they’re foreseeable—even if the exact amount isn’t confirmed yet.

3. Consistency Principle Mistake

- Mistake: Switching accounting methods (e.g., depreciation) frequently or without documentation.

- Fix: Use the same method each year unless there’s a valid reason, and disclose the change if you do switch.

4. Cost Principle Mistake

- Mistake: Adjusting asset values to reflect current market prices.

- Fix: Always report assets at their original purchase price (historical cost), not what they’re worth today—unless the exception applies, like public stock revaluation.

5. Economic Entity Principle Mistake

- Mistake: Mixing personal expenses with business transactions.

- Fix: Keep all personal purchases and income out of business accounts. Use separate cards and bank accounts to avoid confusion.

6. Full Disclosure Principle Mistake

- Mistake: Not including important information that doesn’t show up in the numbers (like lawsuits or major leadership changes).

- Fix: Always share relevant details in the notes section of your financial statements. This builds trust and gives the full picture.

7. Going Concern Principle Mistake

- Mistake: Ignoring signs that the business may not continue (like pending bankruptcy) and still reporting like it will.

- Fix: If your business’s future is uncertain, be transparent in your reports and adjust asset valuations accordingly.

8. Matching Principle Mistake

- Mistake: Recording all expenses when paid instead of matching them to the revenue they helped generate.

- Fix: Spread costs over the time they relate to. For example, if you prepay for insurance or software, expense it monthly, not all at once.

9. Materiality Principle Mistake

- Mistake: Overloading reports with tiny, insignificant items—or ignoring big one-off expenses.

- Fix: Focus on what’s relevant for decision-making. Small expenses can be grouped or skipped, but significant costs must be clearly reported.

10. Monetary Unit Principle Mistake

- Mistake: Recording non-monetary details like hours worked or square footage without converting them to dollar values.

- Fix: Only record transactions that can be measured in money. Leave out qualitative details unless they can be quantified.

11. Reliability Principle Mistake

- Mistake: Logging expenses or revenues without proof (like receipts or contracts).

- Fix: Always back up financial entries with documentation. This keeps your books audit-proof and trustworthy.

12. Revenue Recognition Principle Mistake

- Mistake: Recording revenue when payment is received, not when the work is done.

- Fix: Revenue should be logged when a product is delivered or a service is completed—even if you get paid later.

13. Time Period Principle Mistake

- Mistake: Recording revenue or expenses outside the correct reporting period.

- Fix: Make sure all financial activity is reported in the right fiscal period—this keeps your records accurate and comparable year to year.

Even small errors in applying these principles can lead to inaccurate financial reports, regulatory headaches, or lost investor trust. If you’re not confident handling these details manually, reliable accounting software that follows GAAP rules can really help avoid these slip-ups.

Conclusion

No matter whether you are doing an accounting process manually or using small business finance reporting software, the Generally Accepted Accounting Principles (GAAP) play a significant role in your business accounting.

Since technological advancements are on the rise, using automated processes for accounting can be more effective than manual processes. It makes the business accounting process smoother and more superficial.

If you are looking to optimize your accounting process, consider getting accounting and invoicing software like Moon Invoice that complies with all the fundamental principles. Start your free trial now.